Many financial experts, particularly those who favor the cash-only budget, (check out my thoughts on that topic here) suggest that credit cards are very bad for budgeters and recommend against them. Those who are new to budgeting think that the first step to budgeting is to cut the cord with the credit cards. However, in my experience, I’ve found that credit cards have done wonders for our overall finances…but only if you know how to use them.

Disclaimer: This post contains affiliate links. That means if you click on a link, I may receive a portion of any sales, at no additional cost to you. Please know that while I may receive a small commission for my endorsement, I will only promote items of high quality that I think will benefit you!

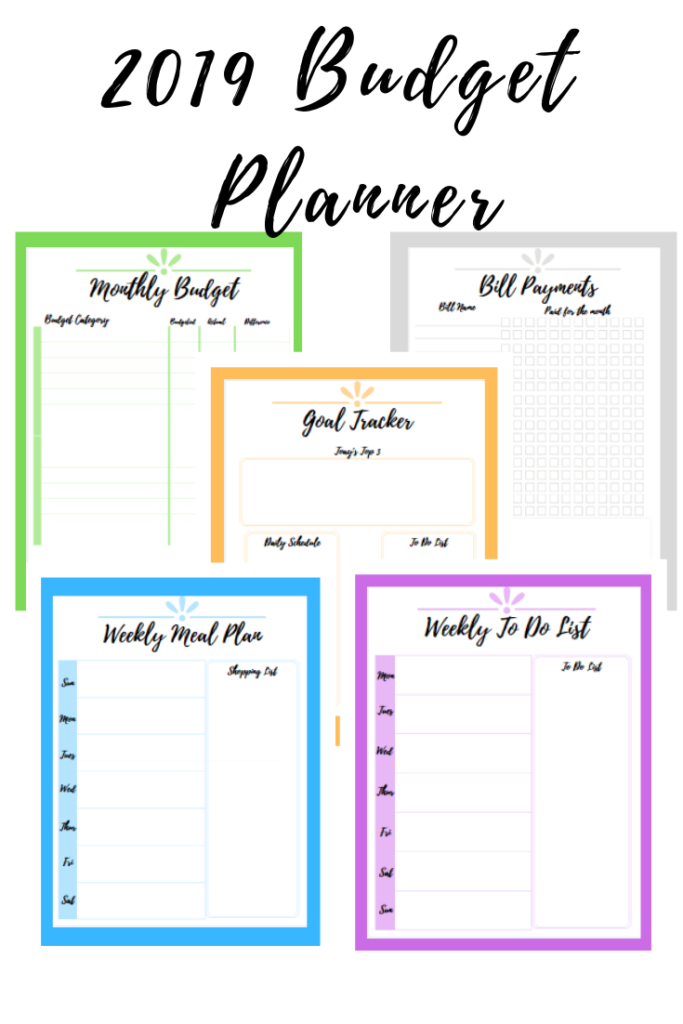

Need a great way to track those credit card bills? We use this awesome bill tracker to make sure that payment gets made! Download your FREE printable here!

Want something a little more in depth, try sorting out your sh*$ with this humorous tracker! (That joke was so worth it)

Are Credit Cards Good for Your Budget?

The first step to figuring out if credit cards are for your budget is to look at your budget history. Credit cards will only benefit you if you pay it off on time! Many people think that credit cards are only for things you cannot afford, and that is the worst advice.

That type of credit card use is what the credit card companies want you to think. It’s how they make money. You purchase an item you can’t afford, and then they charge you interest. Interest is basically lost money, no matter how you slice and dice it.

That interest is how they make money.

A little family tale of credit card use…

I had a conversation with my father-in-law recently about credit cards. I had mentioned that my husband and I were hoping to never take out a loan for anything again, except for our home mortgage. He was shocked and said that it was impossible to buy a car without a loan. He didn’t believe it could be done.

It can be done.

In any case, he went on about how they had paid off their car and had no debt left. Just a few credit card bills they were making payments on, but no debt. What?!

It didn’t count as debt?!

I kindly let him know that unpaid credit cards was 100% debt. He didn’t think it counted. Didn’t think it counted as debt! He was so convinced that credit cards were just to buy things you needed and couldn’t pay for, that it didn’t count as debt as long as you were making payments.

He had learned (and taught my dear husband) that you needed to get a card with as low a percentage as possible because you’d inevitably need it. I was shocked! Credit card debt is a very real thing, and absolutely counts as debt!

Now, I’d hate to be the daughter-in-law to disagree with my in-laws, but let me tell you how wrong and dangerous that thinking is. If you think that is how you use credit cards, then you should just cut them up right now.

Credit Card Rewards, not interest

Since that is the way my husband was raised, he looks very carefully at the interest percentage because that’s what his parents looked at. However, in my home growing up, we didn’t bat an eye at percentages because we never, ever paid any interest. It was always paid off completely every month. We looked at the rewards, rather than the interest.

And that, dear friends, is the secret. We paid over $500 towards our Hawaiian Honeymoon just on credit card rewards alone. The secret is to pay it off every month.

Need a great way to track those credit card bills? We use this awesome bill tracker to make sure that payment gets made! Download your FREE printable here!

In fact, go online and pay it off early! A little credit score hack, is to use your credit card for everything (literally everything), and then pay it off ASAP. If you pay it off early, it will reduce the amount of credit reported to the score agencies, and help your credit score. Be careful not to pay it all off early every time, or it won’t show as being used. Equally bad.

So, my dear readers, credit cards can be good for your budget…but only if you use them correctly!

How do you use your credit cards? Any other hacks you use? I’ve heard rumor people get some mean travel discounts using credit cards, too! Speaking of that, if you do plan to travel with your cards, (even out on the town), I highly recommend an RFID-blocking case! Check out these cute ones here!

Still think a cash only budget is the way to go?

Still not convinced? That’s fine, here are some pretty sweet color-coded envelopes for a cash only budget that you can check out instead.

I even have a whole post on cash-only budgets that you can check out here!

And, just so you don’t think that I’m all anti-cash and all credit, you can check out my full budget line-up here and what we actually use in addition to our credit cards! (Spoiler, we do use some cash)